FREQUENTLY ASKED QUESTIONS:

INVESTMENT ADVISER REPRESENTATIVE CONTINUING EDUCATION

The North American Securities Administrators Association (NASAA) announced on November 30, 2020 that its membership voted to adopt a model rule to set parameters by which NASAA members could implement continuing education programs for investment adviser representatives in their jurisdictions. The model rule has a products and practice component and an ethics component and is intended to be compatible with other continuing education programs. The model rule is available here.

The model rule represents the culmination of years of work by state securities regulators and industry to develop a relevant and responsive continuing education program. This successful collaboration will help promote heightened regulatory compliance while also helping investment adviser representatives better serve their clients by remaining knowledgeable of current regulatory requirements and best practices.

Below are answers to frequently asked questions about the Investment Adviser Representative Continuing Education initiative. The latest additions to the FAQs are at the top of each category.

Updated: May 1, 2024

A printable version of the IAR CE FAQs is available here.

GENERAL

Who does the Investment Adviser Representative Continuing Education (IAR CE) requirement apply to?

Every investment adviser representative (IAR) registered with a jurisdiction that has adopted the model rule is subject to its CE requirements. The program applies to all registered IARs of both state-registered and federal covered investment advisers in that jurisdiction.

A common misconception is that the requirement is triggered by where the IA firm is registered or notice filed. However, the requirement is applied based on where the IAR is registered regardless of where the IAR is domiciled or the firm is registered or notice filed.

Are IARs required to take specific courses?

No, IARs are free to select approved courses that appeal to their interests and business models so long as they meet the credit requirements, and the courses are approved content for the IAR CE program. The program provides maximum flexibility for IARs to select approved courses that best align with their interests and work.

Unless the IAR’s employer provides different internal guidance, the IAR can select a provider from NASAA’s Approved Provider’s list. Then the IAR should work with that content provider to select courses that meet the IAR CE requirements, six credits of Ethics and Professional Responsibility and six credits of Products and Practice.

Do IARs have an annual IAR CE requirement immediately upon registration in an IAR CE state?

Why does the system still list my IAR CE status as “IAR CE Required” when I dropped my registration with the state that required IAR CE?

IAR CE requirements are maintained if an IAR has been registered with a state which requires IAR CE (an in-scope state) for any part of the year. Thus, even if an IAR withdraws from an in-scope state, the requirement continues to exist and may affect future registration(s) in in-scope states. Essentially, once an IAR has the requirement, they will always have the requirement and the deficiency will continue to accumulate to a maximum of 36 credits if not maintained annually.

This is true beyond the current reporting year. The IAR should remain current on their IAR CE requirements to ensure that future state registrations aren’t impacted. An IAR CE deficiency will not impact state registrations in states that haven’t adopted the rule. However, if that state adopts the requirement in the future, the IAR’s registration will be impacted on the rule’s effective date if the IAR hasn’t maintained the requirement.

CREDIT HOURS & REPORTING

Who reports course completion?

With the exception of FINRA’s Regulatory Element CE, the course providers report course completion to FINRA, NASAA’s vendor for program tracking. There is no need to directly report the completion of CE to your state securities regulator.

Is there a reporting fee?

Yes, the IAR CE course reporting fee, also sometimes referred to as the roster fee, is $3 per credit per person.

When is the reporting fee due and how is it paid?

When the course provider submits an IAR’s completed course for credit, the $3 per credit is due upon submission. The course provider submits the course completion information to FINRA, the manager of NASAA’s CE reporting database. After successful submission of the course roster, the system will generate the accompanying invoice for the roster fees to be paid by the course provider.

If an individual is reporting FINRA Regulatory Element CE to satisfy IAR CE’s six credits of Products and Practice, he or she will pay the associated $18 through FinPro, unless the firm has opted in to pay the fee for all of its IARs.

When do IARs need to begin complying with the CE program?

The IAR CE requirement begins on January 1 of the calendar year following a jurisdiction’s adoption. An IAR registered in a state that has enacted an IAR CE requirement can begin taking IAR CE courses on January 1 and all CE credits must be reported by the end of the calendar year. IARs without an existing IAR CE requirement that register with an IAR CE state for the first time will not need to begin completing coursework until January of the first full calendar year following the year in which they first become registered.

How many credits/hours are required?

IARs need to attain 12 CE credits each year to maintain their IAR registration. A “credit” is a unit that has been designated by NASAA to be at least 50 minutes of educational instruction. The 12 credits must include 6 credits of Products and Practices and 6 credits of Ethics and Professional Responsibility.

Please note, the credits must be split this way. If an IAR takes 8 credits of Products and Practice and 4 credits of Ethics and Professional Responsibility, they will not satisfy that year’s requirements even though they attained 12 total credits.

What is the Products and Practice component of IAR CE model rule?

The Products and Practice component is designed to ensure ongoing knowledge and competency related to investment products, strategies, standards, and compliance practices relevant to the investment advisory industry. An IAR must satisfy six credits annually of this component.

An IAR who is dually registered as a broker-dealer agent may report their completed FINRA Regulatory Element CE to satisfy six credits of the Products and Practice component.

What is the Ethics and Professional Responsibility component of IAR CE model rule?

The Ethics and Professional Responsibility component is designed to ensure ongoing knowledge and competency related to an IAR’s duties and obligations to his or her clients including, but not limited to, issues related to the fiduciary duty owed to each client.

Every Ethics and Professional Responsibility course must ensure that at least one-half (50%) of the material in the course is related to an IAR’s ethical responsibility. Therefore, by taking all 6 credits, the IAR meets the 3 credits of ethics that is required by the Model Rule. This ensures that every IAR can meet the ethics component of the IAR CE model rule. If course providers are unable to certify that content on ethical responsibility is covered or if content reviews determine that content on ethical responsibility is insufficient, those courses will not be approved.

An IAR must satisfy six credits annually of this component.

If an IAR earns more than 12 CE credits in a year, can he or she carry the excess credits over to the next year?

No. An IAR who completes more CE credits than are required for the year may not carry forward excess credits into a subsequent year.

Can an IAR complete the same CE course more than once?

IAR CE tracking in CRD will include duplicate courses in the course transcript section if reported, but duplicate courses will not count toward the IAR CE requirement, even if completed in a subsequent year. Each course must have a unique course identification number in order for an IAR to receive credit.

What if an IAR changes firms mid-year?

If an IAR begins taking courses during a calendar year, then changes firms mid-year, the credits completed before the switch will appear in the IAR’s course transcript in CRD and will apply toward the annual CE requirement.

Does an IAR need to make up missed CE credits?

Yes. Courses completed in the current year will first apply to the past year if there is a deficiency to be resolved, and then to the current year’s requirement.

Example: Joe failed to complete his IAR CE requirement in 2022. Any IAR CE courses he completes in 2023 will be applied to the 2022 deficiency until that requirement is completed. Excess credits in 2023 will not be applied to the 2024 IAR CE requirement.

Can instructors who are also IARs receive CE credits for the courses that they teach?

Yes. However, the course instructor must first apply to be an approved instructor and get the associated course approved as well.* CE credit can only be applied to the instructor once for each unique course he or she leads.

*Information on the IAR CE approval process with Prometric can be found here.

Do correspondence and self-study courses count?

Yes, there is no limitation/maximum credits restriction for courses delivered as self-study or a similar method. However, these courses must be officially approved by Prometric and NASAA before they can count toward CE credits under the IAR CE Program.

How does an IAR ensure that the IAR’s completion of the annual CE requirement is reflected in CRD?

Course completion is a shared responsibility between the instructor, the course provider, and the IAR. The IAR is responsible for attending class at the designated time and completing an assessment (if required) associated with that course to receive the CE credits for the course. The IAR may also be asked to complete a satisfaction survey as part of the course activities required for CE credit.

The IAR is responsible for ensuring that the course provider reports the IAR’s completion of the course by collecting the IAR’s CRD number, and first and last names. The IAR may want to ensure they receive documentation for courses attended. The IAR can self-monitor course submissions by logging into their FinPro account.

How do I sign up for a FinPro account?

IAR’s will monitor their IAR CE through FINRA’s FinPro system.

Go to https://www.finra.org/registration-exams-ce/finpro to create an account.

Please see the User Guide and Video Tutorial for help setting up your account.

Can I count my FINRA Regulatory Element continuing education towards my IAR CE requirement?

Yes, you can use FINRA’s Regulatory Element course towards the Products and Practice component of your IAR CE requirements. Please note, you must speak with your broker-dealer to determine if they want to report it on your behalf or if you should self-report your course completion through FinPro and pay the applicable reporting fee of $18 ($3 per credit hour times six credits). To self-report the completion, you will need to log in to FinPro and scroll to the “Continuing Education” section where you should see a header for IAR CE. Next to your “Incomplete” status, click the “Apply Regulatory Element Credit” link and follow the prompts to pay the reporting fee.

Please note, there will be no refunds. In addition, if for any reason your reporting fee payment is not processed or is charged back you will not receive the corresponding IAR CE credits.

Can I count my FINRA MQP continuing education towards my IAR CE requirement?

Yes, because MQP CE consists of both Regulatory Element and Practical Element you can use FINRA’s MQP CE towards the Products and Practice component of your IAR CE requirements. You will need to self-report your course completion through FinPro and pay the applicable reporting fee of $18 ($3 per credit hour times six credits). To self-report the completion, you will need to log in to FinPro and scroll to the “Continuing Education” section where you should see a header for IAR CE. Next to your “Incomplete” status, click the “Apply Regulatory Element Credit” link and follow the prompts to pay the reporting fee.

Please note, there will be no refunds. In addition, if for any reason your reporting fee payment is not processed or is charged back you will not receive the corresponding IAR CE credits.

I received a waiver from my home state’s IAR CE requirement. Do I still need to complete my IAR CE annual requirement?

An IAR CE waiver will exempt you from completing IAR CE with only the state which granted you the waiver. If you are registered in multiple CE states, you will still have the IAR CE requirement in any states not granting a waiver. Further, if you are registered in a state which later adopts the requirement, a waiver in another state will not prevent required credits from accumulating and you will still need to make up missing IAR CE credits to comply with any CE state not waiving the IAR CE requirement. (Note that waivers will usually only be granted under extraordinary circumstances.)

When are IAR CE courses due?

IAR CE courses must be reflected on the IAR’s IAR CE transcript in the CRD system by the end of each calendar year. For courses to reflect on an IAR’s transcript the IAR must complete the IAR CE course, the IAR CE Provider must report the course completion to FINRA, and FINRA must accept and process the roster. When an IAR has not completed CE requirements for the previous year and the current year, the credits must reflect in the CRD System before the CRD System Shutdown Date of the second year. The CRD System Shutdown Date is a date determined by FINRA each year on which the CRD system is shut down for end of year processing. Course completions must reflect in CRD before this date to be accounted for in end of year IAR CE registration processing.

What is the CRD System Shutdown Date?

The CRD System Shutdown Date is a date determined by FINRA each year on which the CRD system is shut down for end of year processing. Course completions must be submitted before this date in order to be applied to the current year’s IAR CE processing of CE and registration statuses.

COURSE CONTENT AND PROVIDERS

Who will provide CE that meets the requirements of the program under the model rule?

Under the model rule, IARs are required to take approved CE courses from approved course providers. NASAA has developed standardized criteria under which potential IAR CE content providers and individual CE courses will be approved. Any vendor, firm, individual, or state may provide CE so long as the provider, instructor (if applicable) and course are approved.

Who is eligible to submit courses for approval?

Anyone can submit courses for approval once they are an approved provider; they are required to apply with their course materials and meet the established course criteria, which will be reviewed and approved by Prometric.

What is the process for obtaining approval of providers and courses?

NASAA has retained Prometric to review and approve providers, instructors and courses in accordance with criteria established by NASAA’s IAR CE Committee. The application process and website to apply can be found at Investment Adviser Representative Continuing Education.

What criteria will be used to assess potential IAR CE providers and course content?

Potential IAR CE providers, instructors, and course content owners will be assessed on standard criteria available for review in the IAR CE Program Handbook.

What if a firm wants approval of course materials that include proprietary information?

A firm will need to go through the same approval process as other providers. A firm specific class can be limited to associated persons of that firm. The course content evaluation materials and requirements are available for review in the IAR CE Program Handbook.

Is there a requirement for a course assessment or test and, if so, what is that requirement?

Every self-study and on demand course must have an assessment. There is also a requirement that IARs pass assessments with a score of at least 70% within no more than three attempts. Find more information about assessment requirements in the Program Handbook.

As of August 1, 2023, if the course is a live instructor-led course, the instructor must provide an opportunity for audience engagement rather than an assessment. Email NASAA at iarce@nasaa.org to find out more about this updated requirement.

How can someone become a continuing education provider?

To become a registered continuing education provider under the IAR CE Program, you must complete the course provider application. The application process and website to apply can be found at Investment Adviser Representative Continuing Education. For additional information, please also review the IAR CE Program Handbook.

Prometric canchrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https:/www.nasaa.org/wp-content/uploads/2023/01/NASAA-CE-Program-Handbook-V3.pdf be reached by phone at 800.742.8731, OR by e-mail at CESecuritiesSupport@Prometric.com.

IARS REGISTERED IN MULTIPLE STATES

What if the IAR's home state has not adopted the model rule but he or she is registered in another state that has adopted the model rule?

If the IAR’s home state has not adopted the model rule, the IAR must still comply with the CE requirements of each of the other states in which he or she is registered as an IAR. See also the following questions and responses.

Will an IAR receive reciprocity in other states if the IAR meets the CE requirements of his or her home state?

An IAR registered in another state who is also registered as an IAR in his or her home state is in compliance if the home state has CE requirements that are at least as stringent as the model rule and the IAR is in compliance with the home state’s IAR CE requirements. Said another way, even if the IAR is registered with multiple states that have an IAR CE requirement, the IAR will only need to complete the 12-credit requirement once per year.

If an IAR has an active IAR registration in a state with IAR CE requirements and adds another IAR CE state, will the current year IAR CE completion requirement apply to the new state?

Yes. If an IAR has an active registration in a state that requires IAR CE and adds another IAR CE state, the current IAR CE completion requirement will apply to the new state. As a practical matter, the IAR will only need to complete 12 credits annually to meet the IAR CE requirements of both states.

Who can be contacted with questions regarding a state's requirements?

For any questions regarding a jurisdiction’s specific requirements, please contact that jurisdiction’s securities regulator. Contact information is available here.

DUAL REGISTRANTS

For dual registrants, can the CE required by FINRA for BD agents meet any of the CE requirements for IARs?

An IAR who is also a registered BD agent and who complies with FINRA’s CE requirements can report the completion of their Regulatory Element CE to satisfy their requirement to complete six credits of Products and Practices content, so long as the FINRA CE content continues to meet certain baseline criteria as determined by NASAA, and the associated roster reporting fee of $3 per credit is paid by either the firm or the IAR.

Does FINRA Firm Element training count toward IAR CE requirements?

Yes, if the training is approved by Prometric on behalf of NASAA. Anyone, including a BD firm, can seek approval to provide CE that meets the criteria established by NASAA.

PROFESSIONAL DESIGNATIONS

Are any IARs exempt from CE requirements based on factors such as length of experience and/or professional designations?

No. There are no exemptions or waivers available based on age, experience or other qualifications. However, see the FAQ immediately below.

Can the CE required to maintain certain professional designations meet some or all of the CE requirements for IARs?

Yes, credits from CE courses taken to maintain professional designations can apply to the IAR CE program so long as the provider and course have been approved through Prometric for IAR CE purposes. Reach directly out to your approved content provider to inquire which of their courses will satisfy both requirements. The IAR CE approved provider list on NASAA’s website identifies those providers that offer courses approved for both IAR CE and a professional designation.

FAILURE TO COMPLETE

What happens if an IAR does not complete the CE requirements in a timely manner?

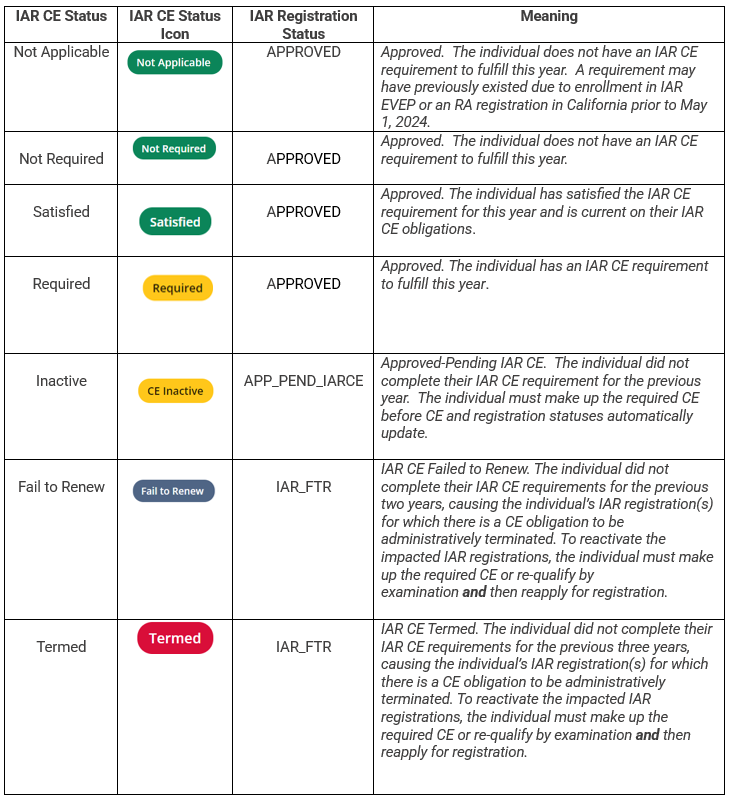

If an IAR does not complete the CE requirement by the annual deadline, the IAR will pay the registration renewal fee and CRD will set his or her IAR CE status to “CE Inactive.” A CE Inactive status is notice to the IAR that if CE is not completed by the CRD System Shutdown date, the IAR will be unable to renew his or her registration. An IAR that is CE Inactive will hold that status in all states where the CE rule is effective following adoption of the model. If a state has not yet adopted the CE model rule, the CE program will have no impact on the registration status of the IARs registered with that state.

What happens if an IAR is CE Inactive during registration renewal season?

An IAR who fails to comply with CE requirements by the end of the first 12-month reporting period will renew as “CE Inactive”. An IAR who remains CE Inactive at the end of the following year and has not completed the CE requirements by the CRD System Shutdown date is not eligible for IAR registration or renewal of an IAR registration.

How does a CE Inactive IAR become current with the CE requirement?

IAR CE credits completed in any year will first be applied to the previous year and then to the current year’s requirement. The IAR’s IAR CE status will be automatically updated to satisfied once the IAR has obtained the required number of CE credits.

Why did I Fail to Renew on January 1 even though I have paid my registration renewal fee and intended to remain registered?

If you automatically failed to renew on January 1, you may be deficient in IAR CE. If you were registered for any portion of a year in an IAR CE state, you had an IAR CE required status and were required to complete IAR CE annually. Because you failed to satisfy your IAR CE requirement for two consecutive years, your registration failed to renew in all IAR CE states. You will be required to catch up on your deficient IAR CE before resubmitting your U4 for state registration. You will then be required to complete 12 credits of IAR CE annually thereafter.

I was previously registered in an IAR CE state but dropped that registration and did not complete the required IAR CE. Now another state I am registered in has adopted the IAR CE requirement. What will happen on January 1 if I do not complete the IAR CE?

If you failed to satisfy your IAR CE requirement for two consecutive years, your registration will fail to renew in all IAR CE states. You will be required to catch up on your deficient IAR CE before resubmitting your U4 for state registration. You will then be required to complete 12 credits of IAR CE annually thereafter.

If you failed to satisfy your IAR CE requirement for one year (12 credits), your registration status will update to “Approved – Pending IAR CE” in all IAR CE states. You will be required to catch up on your deficient IAR CE which is 12 credits plus the current year’s requirement of 12 credits and then annually thereafter.

Why am I already deficient IAR CE when my state just adopted IAR CE on January 1?

If you were registered for any portion of a year in an IAR CE state, you had an IAR CE required status and were required to complete IAR CE annually. Because you failed to satisfy your IAR CE requirement for one year (12 credits), your registration status will update to “Approved – Pending IAR CE” in all IAR CE states. You will be required to catch up on your deficient IAR CE which is 12 credits plus the current year’s requirement of 12 credits and then annually thereafter.