Are you an informed investor?

Opportunity Zone Investments

Opportunity zones encourage longer-term investments in low-income U.S. communities by providing certain tax benefits to investors. Investors may be attracted to opportunity zone investments for the potential tax benefits and promise of return on investment. Investors should weigh various factors before deciding to invest. Just because an investment is available in an opportunity zone does not automatically make it right for you.

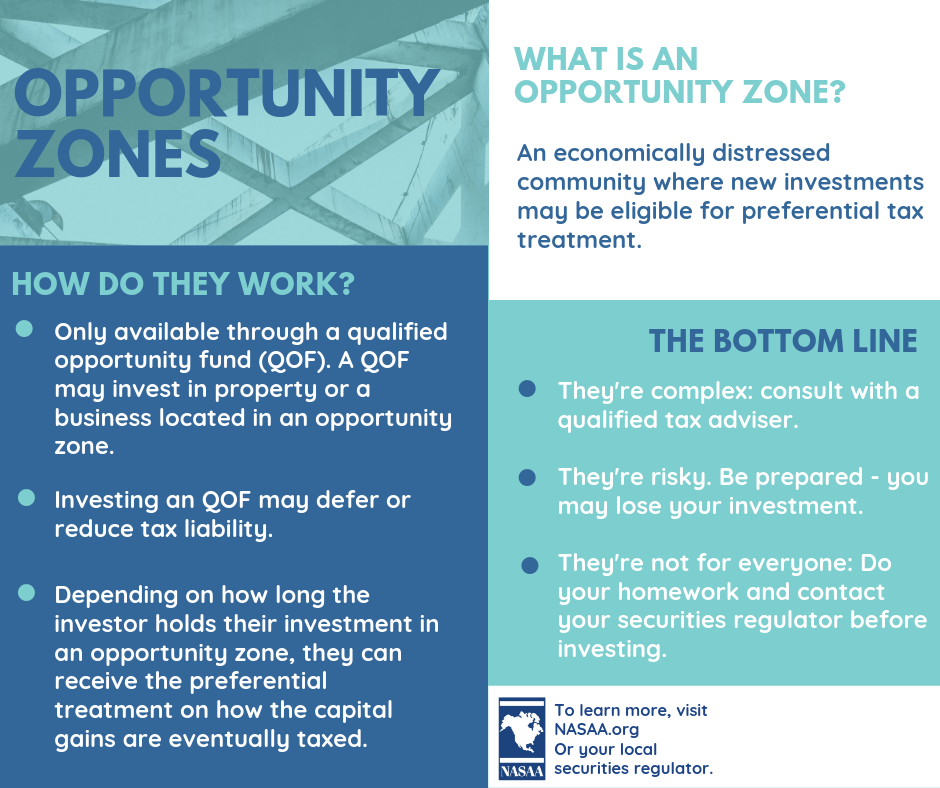

What is an Opportunity Zone?

An Opportunity Zone is an economically distressed community where new investments, under certain conditions, may be eligible for preferential tax treatment. They were added to the U.S. tax code as part of the 2017 Tax Cuts and Jobs Act to encourage investment in economically distressed communities.

How do Investments in Opportunity Zones Work?

These types of investments are available only through a qualified opportunity fund (QOF). A QOF may invest in property or a business located in an opportunity zone.

When investors recognize capital gains from other investments (e.g. the sale of a stock, bond, or other piece of investment real estate like a rental property), they are usually taxed on the gains. To defer or reduce tax liability, investors can invest in a QOF. Investors considering these investments should consult with their qualified tax adviser because of the complex tax implications.

Depending on how long the investor holds their investment in an opportunity zone, they can receive the preferential treatment on how the capital gains are eventually taxed. The benefits include immediate tax deferral on the gain, and steps up in basis after five, seven and 10 years.

|

EXAMPLE: An investor buys a public company’s stock in 2016 for $500. In 2018, the investor sells the stock for $600, recognizing a gain of $100. Within 180 days, the investor invests the $100 gain into a QOF. As a result, the investor owes no tax on the $100 gain from the sale of stock, and can defer being taxed until the earlier of December 31, 2026 or the sale of the interest in the QOF. After five years, the investor’s basis in the public company’s stock is increased by 10% of the deferred gain from $500 to $510, which will result in less of the gain being subject to tax. Two years later (seven years after the initial investment into the QOF), the investor’s basis is increased by another 5%, and the investor now has a basis of $515 in the public company stock sold in 2018. As a result, if the investor sells their investment in the QOF after seven years or on December 31, 2026 (whichever is earlier), the investor will only be taxed on $85 of gain, rather than the $100 gain originally invested. If after 10 years of holding the QOF investment, the investor sells the QOF for $150, the $50 gain realized from the QOF sale would be exempt from taxes. However, the investor still would have been required to pay taxes on $85 of the original $100 capital gain from the 2018 public stock sale used to invest in the QOF. |

Considerations for Investors

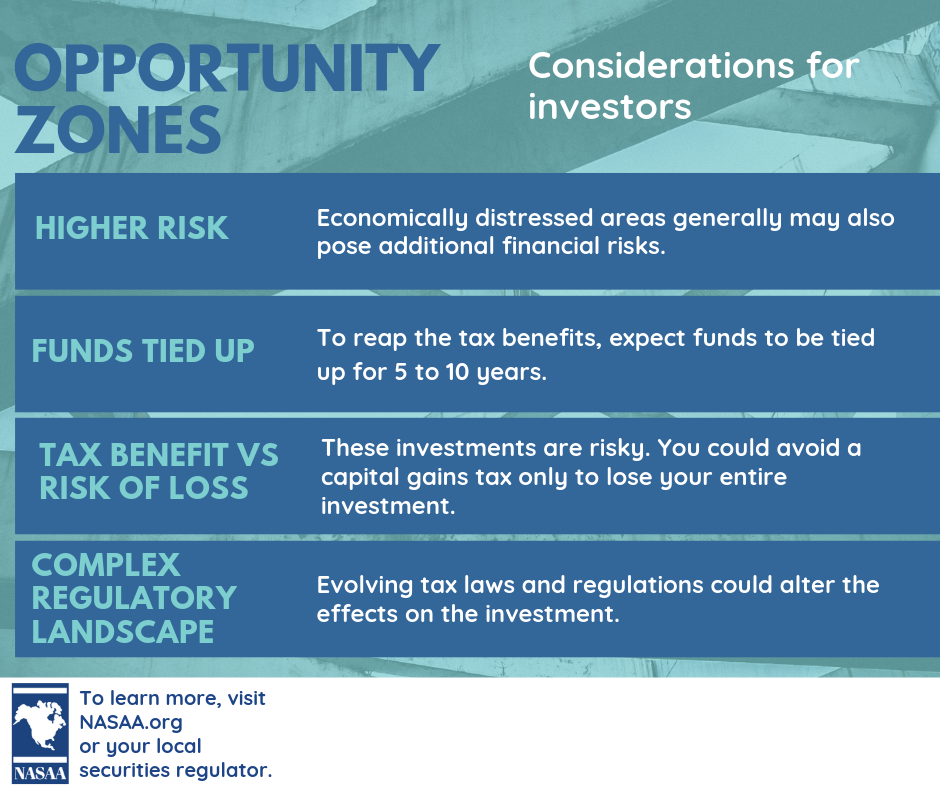

Investors should be aware of the following risks when considering opportunity zone investments:

Economically Distressed Area: Just because the property is located within an opportunity zone does not automatically make it a good investment. To the contrary, opportunity zones are economically distressed areas which pose additional risks of loss.

Complex Regulatory Landscape: Evolving tax laws and regulations could alter the effects on the investment.

Tax Benefit vs. Risk of Loss: While the short- and long-term tax benefits are attractive, opportunity zone investments are still risky. An investor could avoid a capital gains tax only to lose their entire investment in the QOF.

Funds Tied Up: Will you need this money in the next five, seven, or 10 years? The longer the investor leaves their money in, the greater the potential tax benefit.

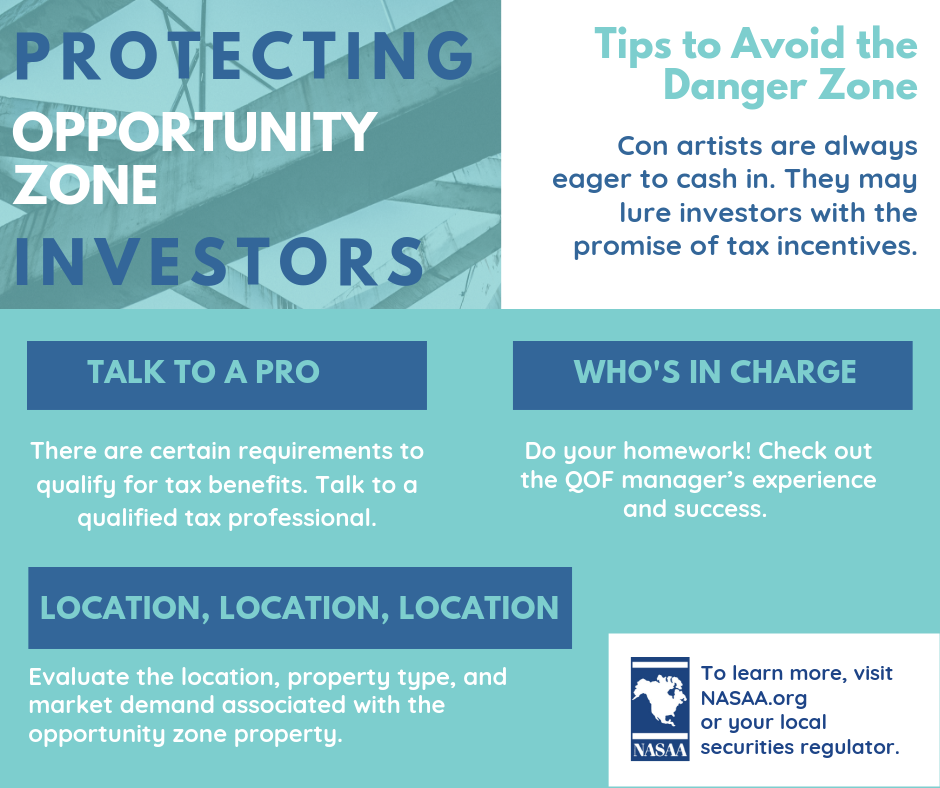

How do Investors Protect Themselves

Do Your Due Diligence: Investors should evaluate the location, property type, and market demand associated with the opportunity zone property. A list of qualified opportunity zones is available on the IRS website here.

Consult with a Tax Professional/Advisor: A QOF must meet certain requirements to qualify for tax benefits. Investors should consult with a tax professional to determine if these requirements have been met, and whether investing in an opportunity zone makes sense for their financial situation.

Evaluate the QOF Manager: Opportunity zones are a new program, making it difficult to determine how the experience of the QOF manager may translate to opportunity zone investment success. Is the fund manager subject to investment adviser registration requirements? Do they have experience with other tax incentivized investment programs? Have they operated investments in economically distressed areas? How will the fund manager be compensated and what other fees will investors pay?

Be Wary of Scams

Con artists have preyed on investors with the promise of preferential tax treatment before. For example, con artists have used conservation easements to lure investors with the promise of charitable contribution deductions in amounts that significantly exceeded the amount invested. More information is available here.

In another example, con artists have used the EB-5 visa program to perpetrate scams involving economically distressed areas. For more information, see NASAA’s EB-5 Investor Advisory, available here.

Additional Information

The North American Securities Administrators Association (NASAA) and the U.S. Securities and Exchange Commission (SEC) recently issued a summary that explains the application of the federal and state securities laws to opportunity zone investments. The summary discusses the opportunity zone program and when interests in qualified opportunity funds would be securities under federal and state securities laws. It also provides an overview of the SEC and state requirements relating to qualified opportunity funds and their securities offerings, broker-dealer registration, and considerations for advisers to a qualified opportunity fund. The summary is available here.

The Bottom Line

Fraudsters are willing and ready to exploit the hype around investments involving tax incentives, including opportunity zone investments. Real estate investments can be subject to their own unique set of risks depending on location, the market, economic trends, and myriad other factors that affect property values. Moreover, these investments are complex and require a lot of guidance. If you choose to invest in an opportunity zone investment, be prepared to lose the entire amount of your investment. Before making any financial decisions, do your homework and contact your state or provincial securities regulator with any questions.Contact information is available on the NASAA website, here.

Infographics

|

||

|

||

|

Posted: July 2019

NASAA provides this information as a service to investors. It is neither a legal interpretation nor an indication of a policy position by NASAA or any of its members, the state and provincial securities regulators. If you have questions concerning the meaning or application of a particular state or provincial law, rule or regulation, please consult an attorney who specializes in securities law.