Are you an informed investor?

Expense Ratios

Mutual funds and exchange traded funds (ETFs) offer investors a cost-efficient way to invest in professionally managed portfolios of securities. While it is often tempting to make a purchase based on a fund’s historical performance, informed investors know that past performance is no guarantee of future performance, and that they must review a fund’s prospectus, shareholder reports and portfolio holdings to see if the fund’s risk/return profile aligns with theirs. An informed investor will pay particular attention to a fund’s expense ratio, which, over time, can eat into a fund’s earnings significantly.

What is an expense ratio?

Expense ratios, sometimes known as management expense ratios (MERs), are calculations that reflect how much funds charge their investors on an ongoing basis. Expense ratios reflect all recurring fees a fund charges (including management fees, administrative fees and distribution fees) but not potential one-off fees an investor might pay (such as fees to purchase or sell shares, commonly known as “sales loads,” or brokerage fees). Investors thus should consider a fund’s expense ratio as well as any sales loads when evaluating the overall cost of investing in a fund.

Funds can be broadly categorized into “no-load funds” (i.e., funds that do not charge a fee at the time an investor purchases shares or sells shares) and “load funds” (i.e., funds that do charge such a fee). Expense ratios for no-load funds and load funds thus are not comparable, as the expense ratio for the load fund will not account for these additional fees.

How is a fund’s expense ratio calculated?

An expense ratio is calculated by dividing the fund’s operating expenses by the average dollar value for all of the assets under management within the fund. In other words:

While both mutual funds and ETFs have expense ratios, ETF expense ratios may be lower because they generally are not actively managed (like some mutual funds). For more information on exchange traded funds, see NASAA’s Informed Investor Advisory on Exchange Traded Funds.

A fund’s operating expenses include several different types of expenses paid out of the fund’s assets and can be broadly put into three categories:

Management Fees paid to the fund’s investment adviser for managing the fund’s investment portfolio;

Administrative Fees paid for custodial, brokerage, tax, auditing and other expenses incurred by the fund; and

Distribution or Service Fees paid to cover certain shareholder services (such as the costs of marketing fund shares, disseminating shareholder reports, and operating investor call centers). In the United States, the Financial Industry Regulatory Authority (FINRA) caps distribution fees (also known as 12b-1 fees) at 0.75% of a fund’s average net assets on an annual basis. Fees may also include shareholder services expenses for fees paid to respond to investor inquiries and provide information to investors about the fund. FINRA also caps the acceptable threshold for shareholder expenses at 0.25%. (In Canada, expense ratios generally are not capped.)

Why are expense ratios important?

A mutual fund’s expense ratio can substantially impact an investor’s returns. For example, if a fund achieves a nominal annual return of 4% but imposes a 2% expense ratio on its investors, investors will realize only a 2% gain.

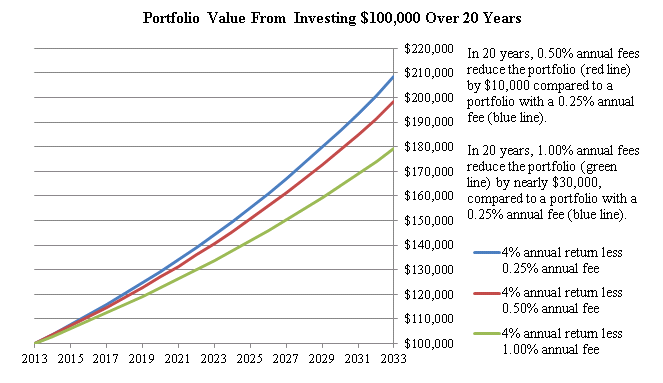

Over time, this can cost investors a lot of money. The three hypothetical funds below each assume steady 4% annual returns. However, the Blue Fund’s expense ratio is .25%, the Red Fund’s expense ratio is .50%, and the Green Fund’s expense ratio is 1%. After 20 years, the difference in the three funds’ values – attributable entirely to the difference in fees – can be seen clearly.

Source: Investor.gov

Source: Investor.gov

Investors should compare expenses when researching funds by reviewing the fund’s prospectus and checking reputable financial websites. FINRA also provides a free Mutual Fund Analyzer to help investors compare mutual fund expenses. When working with a financial professional, he or she should be able to share information about the expenses associated with the fund. By conducting this research, an investor may discover funds with similar investment objectives, offering similar returns but with different expense ratios.

Factors Affecting Mutual Fund Expense Ratios

Passive vs. Active Management – The single biggest determinant of a fund’s expense ratio is likely to be whether the fund is passively managed or actively managed. Passively managed funds, often known as “index funds,” adhere to nondiscretionary investment strategies that do not require substantial ongoing oversight by the fund’s asset manager. In actively managed funds, by contrast, the asset manager will be heavily involved in the fund, making discretionary investment decisions of what to buy and sell. Actively managed funds almost always have higher expense ratios that passively managed funds because of the higher level of ongoing portfolio management services required.

Investment Strategy – Equity funds may have higher expense ratios than bond funds, other things being equal, because of the potentially greater risks and complexities inherent in equity securities. Similarly, the more complex and labor-intensive a fund’s investment strategy is, the more likely it is to have a higher expense ratio. For instance, international funds may have higher expense ratios than domestic funds to cover the costs of maintaining international research operations.

Portfolio Size – Small funds (that is, funds with low total assets) are likely to have higher expense ratios than larger funds because smaller funds will necessarily have fewer assets against which to assess their operating costs.

The Bottom Line

When comparing funds, investors should evaluate the funds’ overall risk/return profiles. Expense ratios are an important element in such comparisons.

Posted: June 2021

NASAA has provided this information as a service to investors. It is neither a legal interpretation nor an indication of a policy position by NASAA or any of its members, the state and provincial securities regulators. If you have questions concerning the meaning or application of a particular state law or rule or regulation, or a NASAA model rule, statement of policy or other materials, please consult with an attorney who specializes in securities law.