Seminars, Specialists and Abusive Sales Practices

State securities regulators warn senior investors to be aware that a combination of “free lunch” seminars, misleading professional “senior specialist” designations, and abusive sales practices can create a perfect storm for investment fraud. Remember: there’s no such thing as a free lunch.

Background

From the “Greatest Generation” to the “Baby Boomers,” seniors have worked hard to build both our nation’s economic prosperity and a lifetime’s worth of savings. In the United States alone, an American turns 50 once every seven seconds and on January 1, 2006, the first of an estimated 77 million baby boomers, those Americans born from 1946 to 1964, celebrated their 60th birthday. The 50-plus population is the fastest growing segment worldwide and predicted life expectancies are at a historical high. Today’s retirees have more than $8.5 trillion in investible assets and over the next 40 years, they stand to inherit at least $7 trillion from their parents, according to industry estimates.

Because seniors are a growing segment of investors, financial services firms are increasingly focusing their marketing and sales of investment products towards senior investors as well as investors nearing retirement age. So too, are criminals.

State and federal securities regulators are increasingly concerned about the possibility of unscrupulous and abusive sales practices and investment fraud targeted towards senior investors. While people age 60 and older make up 15 percent of the U.S. population, they also account for about 30 percent of fraud victims, estimates Consumer Action, a consumer-advocacy group.

Free Meal Sales Seminars

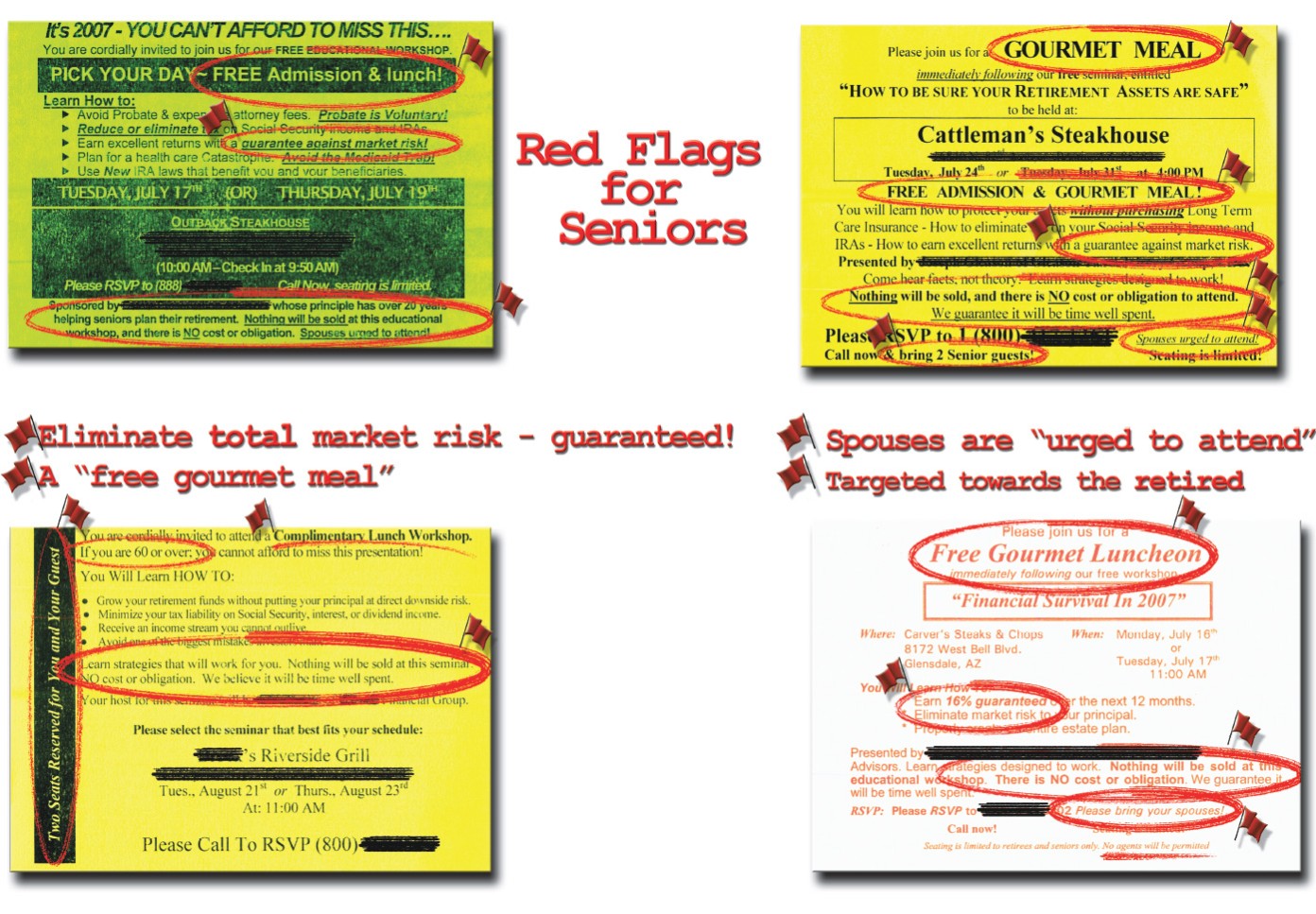

Many individuals over the age of 50 have received an invitation in the mail offering a free lunch or dinner investment seminar. There’s a certain consistency to the invitations enticements: a free gourmet meal, tips on how to earn excellent returns on your investments, eliminate market risk, grow your retirement funds, and, spouses are urged to attend. These words should be red flags for investors.

Free meal sales seminars are often advertised in local newspapers, through mass-mailed invitations, mass-email, and on websites. Sponsors of these seminars offer attractive inducements to attend. The seminars are commonly held at upscale hotels, restaurants, retirement communities, and golf courses. In addition to providing a free meal, the firms and individuals that conduct these seminars often use other incentives such as door prizes, free books, and vacation deals to encourage attendance.

Many free meal seminars are designed to solicit seniors. In addition to a free meal, the bait for many of these seminars is that “income” will be “guaranteed” and substantially higher than the returns someone on a fixed income can expect to get from certificates of deposit, money market investments or other traditional financial products.

Advertised with names like “Seniors Financial Survival Seminar” or “Senior Financial Safety Workshop,” these seminars offer “free” advice by “experts” on how to attain a secure retirement, or offer financial planning or inheritance advice. The advertisements often imply that there is an urgency to attend. For example, invitations include phrases such as “limited seating available” or “call now to reserve a seat.”

And while the ads may stress that the seminars are “educational,” and “nothing will be sold at this workshop,” many of these seminars are intended to result in the attendees’ opening new accounts with the sponsoring firm, and ultimately, in the sales of investment products, if not at the seminar itself, then in follow-up contacts with the attendees. Seniors seeking educational insights and information should be aware that the primary goal of the sponsors of these free meal seminars is to obtain new customers and sell investment products.

These examples of invitations to free meal seminars show the common enticements promoters use to building their audience: a free gourmet meal, tips on how to earn excellent returns on your investments, eliminate market risk, grow your retirement funds, and, spouses are urged to attend. These words should be red flags for investors.

Promoters of free meal seminars often use the promise of high commissions to lure brokers, insurance agents, investment advisers, accountants, and lawyers, some of them not licensed to sell securities, into offering investments they may know little about, such as variable or equity-indexed annuities, limited partnerships or promissory notes. Some of these individuals hold nothing more than a “designation” as “senior specialists” implying that they have expertise in helping seniors structure their retirement portfolios in such a manner as to reduce taxes, minimize risk and avoid state probate laws.

State securities regulators are seeing a variety of violations associated with many of these seminars, ranging from outright lies and the conversion of investor funds to more sophisticated forms of abuse. Often, in a follow-up sales pitch, the salesman recommends liquidating securities positions and using the proceeds to purchase indexed or variable annuity products that the specialist offers. These products are often grossly unsuitable for senior citizens. Securities professionals must know their customers’ financial situation and refrain from recommending investments that they have reason to believe are unsuitable. It pays to remember to make sure your investments match up with your age, your need for access to your money and your tolerance for risk. These recommendations also may constitute the dissemination of investment advice for compensation. If the salesman is not properly licensed, then he or she is offering investment advice as an unregistered investment adviser, which is a violation of state securities law.

Since 2003, when NASAA first identified the risk that seniors face at free meal investment seminars, state securities regulators have been actively investigating and bringing cases to stop the spread of abusive sales practices that often emanate from these events. For example:

- In June, 2007, the Missouri Division of Securities issued a Cease and Desist Order against an Ozark man for allegedly misleading senior investors and using their money for personal expenses, such as credit card and country club bills. The individual, who previously served time in federal prison for fraud, generated potential clients by conducting seminars targeting older investors. During the seminars he would discuss tax, investment, and insurance issues with the participants – but not important facts and risks about the investments he was offering or his felony fraud conviction. The state’s investigation found that of the $1.3 million was transferred between accounts controlled by this individual over a two-year period, only $12,000 remains.

- In Utah, World Group Securities, a broker-dealer based in Duluth, Georgia, agreed to pay a $50,000 fine and strengthen its supervisory practices after two of its agents were found offering “free lunch” seminars for seniors and misrepresenting the credentials of one of the agents. An investigation by the Utah Division of Securities found that the two agents generated their senior clients through investment seminars, where inaccurate and misleading information was presented in an attempt to persuade the seniors to transfer their investment accounts to one of the agents. For example, one agent told seniors that due to his skills, one of his clients could now afford to take three vacations a year and had invited him and his family to join the client on vacation. In truth, the client with whom the agent vacationed was his father.

- In Colorado, the state Division of Securities and county law enforcement authorities won the securities fraud conviction and 20-year prison sentence of a conman who defrauded at least 25 people – older adults for the most part – of almost $600,000 in retirement savings. Between 1999 and December 2002, the fraudster solicited money primarily through “free lunch” seminars and presentations at retirement and senior centers in Colorado and New Mexico.

- In California, the Department of Corporations charged an individual with fraudulently operating as an investment adviser after he made recommendations to some 40 clients, primarily seniors, who invested $15 million in mutual funds. This investment activity generated an average of at least $150,000 annually in commissions for the “adviser” who hosted seminars where seniors commonly received free lunches at country clubs, golf courses, and high-end restaurants. Not only did this individual lack a state license to operate as an investment adviser, but he also had a history of disciplinary actions by the NASD.

Senior Specialist Designations

State securities regulators continue to see another disturbing trend in the area of senior abuse. Increasingly, licensed securities professionals, insurance agents, and unregistered individuals are using impressive-sounding but sometimes highly misleading titles and professional designations. Many of these designations imply that whoever bears the title has a special expertise in addressing the financial needs of seniors.

While some of these designations reflect bona fide credentials in the field of advising seniors, many do not. These titles can serve as an easy way for an unscrupulous sales agent or adviser to gain a senior’s trust, which is the first step in a successful fraud. Often these designations are used in conjunction with “free lunch” seminars. In other cases, they are highlighted in mass mailings, business cards, and other promotional materials.

It is exceedingly difficult for prospective investors – particularly senior citizens – to determine whether a particular designation represents a meaningful credential by the agent or simply an empty marketing device. Use of such professional designations by anyone who does not actually possess special training or expertise is likely to deceive investors.

The use of a designation or a certification by salespersons, whether registered or not registered, may confer an impression with potential customers that the salesperson has special qualifications or specialized education in particular areas of finance, financial planning, estate planning, or investing.

State regulators are concerned that individuals are misusing “senior specialist” designations in aggressive marketing campaigns to provide a false sense of security to their customers. Such aggressive marketing results in unsuitable investments being sold to clients by salespersons who have little or no regard for the individual, specific needs of the senior client or understanding of the product which they are selling.

The requirements to obtain designations and certifications vary greatly, as can the processes for monitoring compliance with a code of conduct or ethics, if any, adopted by the organization which awards the designation or certification. Investors often have insufficient information about the designation or certification when trying to determine which designation or certification represents meaningful educational achievement by the salesperson, or which designation or certification merely represents a marketing tool.

While there are organizations whose members complete rigorous programs of study and pass extensive examinations to earn “senior specialist” designations, there are other organizations that require little or no training to use one of these designations. For this reason, senior investors should make sure they deal only with individuals, licensed by state securities regulator. We license brokers and investment advisers after they pass rigorous competency examinations.

How to Protect Yourself

You can avoid becoming an investment fraud victim by following these self-defense tips developed by NASAA for seniors.

Check out strangers touting strange deals. Trusting strangers is a mistake anyone can make when it comes to their personal finances. Say “no” to any investment professional who presses you to make an immediate decision, giving you no opportunity to check out the salesperson, firm and the investment opportunity itself. Extensive background information on investment salespeople and firms is available from the Central Registration Depository (CRD) files available from your state or provincial securities agency.

Stay in charge of your money. Beware of anyone who suggests investing your money into something you don’t understand or who urges that you leave everything in his or her hands.

Watch out for salespeople who prey on your fears. Con artists know that you worry about either outliving your savings or seeing all of your financial resources vanish overnight as the result of a catastrophic event, such as a costly hospitalization. Fear can cloud your good judgment.

Don’t make a tragedy worse with rash financial decisions. The death or hospitalization of a spouse has many sad consequences – financial fraud shouldn’t be one of them. If you find yourself suddenly in charge of your own finances, get the facts before you make any decisions.

Monitor your investments and ask tough questions. Don’t compound the mistake of trusting an unscrupulous investment professional by failing to keep an eye on the progress of your investment. Insist on regular written reports. Look for signs of excessive or unauthorized trading of your funds.

Look for trouble retrieving your principal or cashing out profits. If a stockbroker, financial planner or other individual with whom you have invested stalls you when you want to pull out your principal or profits, you have uncovered someone who wants to cheat you. Some kinds of investments have certain periods when you cannot withdraw your funds, but you must be made aware of these kinds of restrictions before you invest.

Don’t let embarrassment or fear keep you from reporting investment fraud or abuse. Criminals know that you might hesitate to report that you have been victimized in financial schemes out of embarrassment or fear. Criminals prey on your sensitivities and, in fact, count on these fears preventing or delaying the point at which authorities are notified of a scam. Every day that you delay reporting fraud or abuse is one more day that the criminal is spending your money and finding new victims.