Are you an informed investor?

Initial Loan Procurements

Companies using blockchain technology need to raise capital just like any other company. One way these companies accomplish that is through initial coin offerings (ICOs), which require the new company to create tokens that can be sold to investors and used for the development of new projects. An alternative fundraising method is catching the interest of investors. Initial loan procurements allow companies to raise capital without the added burden of creating tokens.

What is an Initial Loan Procurment?

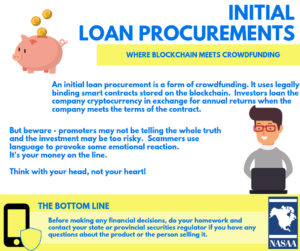

An initial loan procurement is a crowdfunding method that allows borrowers and creditors to enter into loan agreements through legally binding smart contracts stored on the blockchain. Instead of sending money to a smart contract and receiving tokens, as in an ICO, the investor becomes a creditor and lends money to the company. The loan is paid back at an agreed time and is purported to be legally binding. This allows the investor to lend money to a company or project, after entering into an agreement. Just like ICOs, initial loan procurements are marketed to investors worldwide.

How does it Work?

Potential investors input their identification by entering an address among other information on the blockchain. Once all the information is verified, the investor will digitally sign a loan agreement and send cryptocurrency to the company’s address. Once the cryptocurrency is received, and a smart contract signed, the investor is entitled to an annual interest payment.

With ICOs, in which a token is issued, the investors typically get nothing to prove a claim on the company’s assets. However, in an initial loan procurement, the investor receives a legally binding contract with the company that is public on the blockchain.

|

EXAMPLE: Company XYZ is raising capital through crowdfunding on the blockchain, offering initial loan contracts to investors worldwide. An investor wants to invest in XYZ. The investor goes onto the blockchain to invest by initiating a loan to XYZ. In exchange for the loan, XYZ issues a smart contract to the investor that promises a 20% return. The promised return is automatically paid to the investor when XYZ meets the terms of the smart contract. |

Investor Beware

- Initial loan procurements may appeal to investors who want to get into blockchain technology but are wary of the risks of ICOs.

- Investors are given a false sense of security that their money will not be lost because the smart contract cannot be altered on the blockchain.

- Investors may be falsely told that the investment is less volatile because the return is tied to the performance of the company and not to the value of the coin issued in an ICO.

- Investors are falsely promised guaranteed returns.

- Investors are falsely told that companies raising capital using initial loan procurements are vetted, making the investments secure.

- Investors are told the gains are not taxable because they are debt, which may or may not be true.

- Investors are told that initial loan procurements are not subject to the same regulatory scrutiny as other investments.

How do Investors Protect Themselves

Don’t invest money you can’t afford to lose. Initial loan procurements are not the same as other asset classes, like traditional stocks and bonds. Investing in these offerings should be seen as entirely speculative.

Read the fine print. Don’t assume all initial loan procurement offerings are the same or have the same terms.

Research independently. Research the individuals behind the company seeking capital. Ask questions and be skeptical.

Think with your head, not your heart. Scammers often use language intentionally designed to provoke some emotional reaction in their targets. Whatever the appeal, remember that investing is a business decision. Ask yourself, “Is this investment right for me?”

The Bottom Line

Before making any financial decisions, do your homework and contact your state or provincial securities regulator if you have any questions about the product or the person selling it. Contact information is available on the NASAA website, here.

Infographics

|

||

|

||

|

|

|

||

|

||

Posted: July 2019

NASAA provides this information as a service to investors. It is neither a legal interpretation nor an indication of a policy position by NASAA or any of its members, the state and provincial securities regulators. If you have questions concerning the meaning or application of a particular state or provincial law, rule or regulation, please consult an attorney who specializes in securities law.